Galderma’s IPO has been successfully completed in Switzerland. Existing shareholders now get rid of even more shares.

The largest IPO on the Swiss stock exchange SIX by skincare manufacturer Galderma has been the talk of the town for days.

Although the company is actually completely unprofitable and the balance sheet shows a multitude of intangible assets, as reported by muula.ch, investors are scrambling for the shares.

Banks buy more

Late on Tuesday evening, Galderma also announced that the banks involved had exercised their over-allotment option.

This means that previous owners around the private equity firm EQT, as well as the Abu Dhabi Investment Authority and Auba Investment from Singapore, were able to sell shares once again.

300 million raised

Such options are common in IPOs and are exercised when there is a strong demand for the securities.

According to the communiqué, this marked the end of the stabilization phase for Galderma. A further 5.6 million shares were thus sold at the issue price of 53 Swiss francs, raising around 300 million Swiss francs.

Holding periods apply

The total placement volume amounted to around 2.3 billion Swiss francs.

With the full exercise of the over-allotment option, the free float will increase from 20.4 to 22.8 percent, the manufacturer of sun protection products Daylong and Cetaphil further announced.

Lock-up periods, during which certain minimum holding periods apply to the IPO, are generally 180 days.

However, Galderma’s management undertook to hold its shares for at least 360 days from the IPO.

Galderma CEO Flemming Ørnskov received almost 100 million Swiss francs with that transaction.

Well-known banks helped

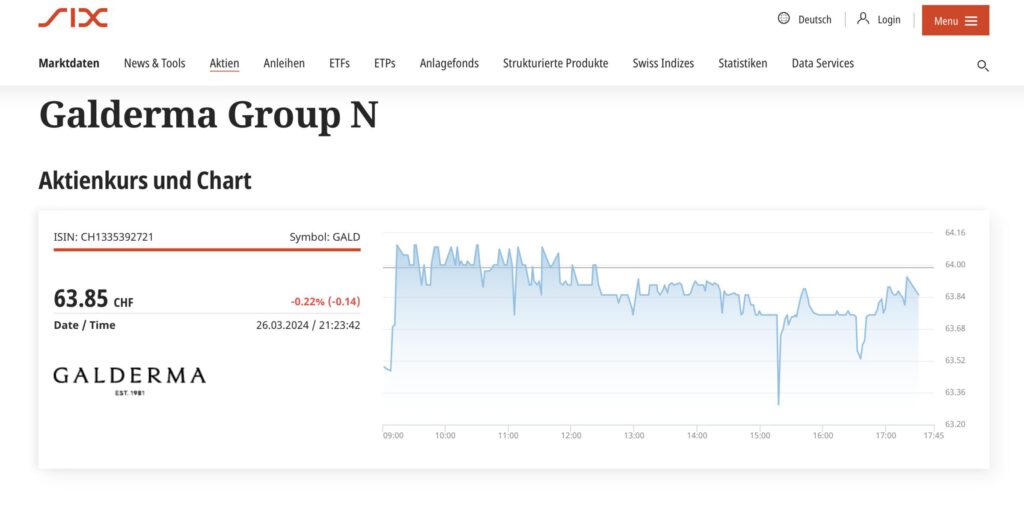

The price trend on the SIX is fairly stable. There were only minor downward outliers.

However, these downward movements were immediately recovered.

The IPO was supported by Goldman Sachs, Morgan Stanley and the major bank UBS. Lazard acted as financial advisor.

26.03.2024/kut./ena.